who pays for builders risk insurance

It is up to the principal owner and the subcontractor to sort things out. Get Free Quotes from Leading Insurers.

Builders Risk Insurance Everything You Need To Know

Homeowners insurance provides coverage for the home itself personal belongings loss of use and personal liability.

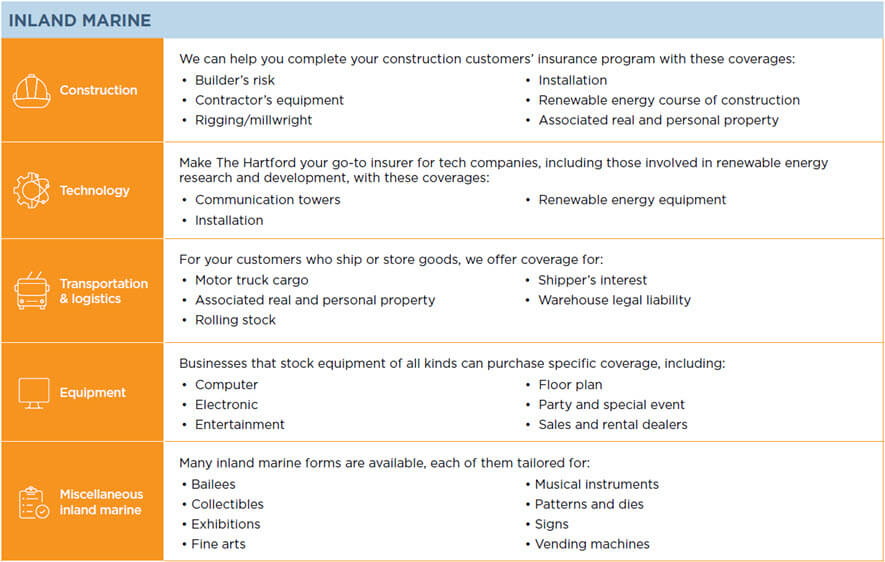

. For example with APOLLOs Builders Risk policy the building owner general contractor or construction manager can all purchase the insurance coverage. Builders risk insurance also known as course of construction insurance is a specialized type of property insurance that helps protect buildings under construction. This is within our expertise and we have a team of experts to ensure you have a full understanding of builders risk insurance.

When insurers are asked by clients how much they can expect to pay for builders risk insurance a common calculation that usually gives a good estimate is that the policy will cost 1-5 of the construction projects total budget. Founded in 1810 it is also one of the oldest insurance companies in the US. The most the insurance company pays for any one loss or damage to covered property is the limit of insurance on the declarations that applies.

Some builders risk insurance offers protection for subcontractors in addition to the owners materials. Its essential in helping protect construction projects but can be complex and often misunderstood. Get a fast quote and your certificate of insurance now.

The Hartford is one of the most financially stable companies offering builders risk insurance. You can customize a policy to protect the particular types of risk on your construction site. Builders risk insurance is a type of property insurance that is obtained for improvements that are being constructed which protects against losses during the construction period that are the result of theft vandalism and acts of nature including fire flood and wind damage.

For example if a bad storm destroys a project while it is in progress builders risk insurance will compensate for the damages so that the project may be continued even after a disaster. Homeowners insurance and builders risk insurance also differ in terms of what type of coverage is included in each policy. Builders risk insurance is a type of property insurance that protects projects that are not yet completed.

Builders risk insurance covers certain kinds of loss or damage to materials equipment and buildings under construction. Builders risk insurance covers damage to a construction project caused by weather fire vandalism or theft. The cost of builders risk insurance typically accounts for 1 to 5 of a businesss total construction budget.

Whether the project owner pays or the GC pays depends on what is negotiated between the owner and the GC as well as the circumstances of the project and on the standard practices. Builders risk typically only offers coverage for the home under construction and building materials. The amount of the builders risk insurance coverage must be.

General contractors may often invest in builders risk insurance in order to protect their work tools and time. This premium ensures protection for the subcontractors tools and materials from different forms of damage. There are typically two parties that may.

For example if your construction budget is. As will be explained below the exact nature of whats covered depends on the terms of the builders risk insurance policy. Builders Risk Insurance.

Builders risk insurance is a type of property insurance that protects projects that are not yet completed. The onus of paying for the builders risk insurance policy usually falls on one of these two parties because they tend to have the most stake in these kinds of projects. The cost of a builders risk insurance policy would depend on the value of the project once it is completed.

That wraps up our article on who pays for builders risk insurance. The sub-limit for coverage on signs is. Who Pays for Builders Risk Insurance.

It covers against theft vandalism wind hail rain and other causes of damage or destruction. In most cases however it is the building owner or the general contractor who buys it. I disagree with this because if the project is damaged when it is 95 finished and the builder has been paid for the finished work the insurance would pay the claim proceeds to both.

But these policies often come at a premium. Get Insurance For Builders Tradesmen online. In other words the early bird gets the builders risk coverage.

Typically this is a decision to be made between the homeowner and contractor. Learn all about who pays for builders risk insurance 27. Get Tailor-Fit Builders Risk Insurance For Your Project.

The general contractor GC The building owner ie. However having a properly structured builder. Generally this type of insurance costs around 1-4 of the completed projects value.

For example if a bad storm destroys a project while it is in progress builders risk insurance will compensate for the damages so that the project may be. Its never too late is a myth - at least when it comes to builders risk. Both of these parties are making the largest investment in the project have the most to lose and therefore stand to benefit the most from builders risk protections.

The general contractors are responsible for handling builders risk policy and pay for deductibles as and when required. For example if a bad storm destroys a project while it is in progress builders risk insurance will compensate for the damages so that the project may be continued even after a disaster. When it comes to builders risk insurance you need to get it early if you want it at all.

Call our licensed agents toll free 8448550163. Bonus Fact 4. Ad BizInsure Provides End-to-end Insurance Solutions.

Best Moodys and SP all rated The Hartford with top. Because of this protection builders risk insurance. Risk Insurance Insurance Policy Builders Risk Insurance Policy more.

Builders risk insurance is a type of property insurance that protects projects that are not yet completed. While working out the details of the given construction project the general. You may submit your questions through the form below or call us at 718 886 6601.

What does builders risk insurance cover TN Policy holders in larger cities like Nashville are also likely to pay a bit more for their 28. Although both the building owner and the general contractor are responsible for. Who pays for builders risk insurance.

The experience level of the contractors and subcontractors involved in the project. GCs are one of the two parties who pay for builders risk insurance before the beginning of the construction project. Typically a builders risk policy is purchased by either.

If an unexpected event harms the structure or materials on your construction site this insurance policy pays for the repairs or replacements needed to get the project back on track. Builders risk insurance is a must-have for contractors and property owners. Project owner As such it is common for the GC or the building owner to pay for the builders risk policy.

After much discussion and them talking to their agent they came back and told us that we should have Builders Risk with both of us being named as co-insures. Who pays for the insurance is usually decided. Builders risk insurance protects your contracting business from lawsuits with rates as low as 37mo.

You cant get this coverage once a project has started it needs to be obtained before work begins. Ad We Researched It For You. Construction Blue Rock October 29 2020 Blue Rock Insurance Services builders risk insurance construction Comment.

However traditionally the policy is paid for by either the general contractor or the land developerowner of the property. If your new home is under construction you may need to carry builders risk insurance that is residential construction insurance. Builders risk insurance will help compensate the contractor for equipment and tools that may have been left on the job site.

Find out what it costs covers more. This is because they are usually the most financially invested in a project and would face the. There are typically two parties that may.

Builders Risk Insurance Builders Risk Insurance Builders Risk.

Builders Risk Insurance Business Insurance The Hartford

Builder S Risk Insurance Do Property Owners Or Contractors Buy It Blue Rock Insurance Services

How A Builder S Risk Insurance Policy Can Protect Your Business Insureon

Who Pays Independent Insurance Agents Match Agents Trusted Choice

How Much Does Commercial Property Insurance Cost Commercial Insurance

Who Pays For Builder S Risk Insurance

Who Pays For A Builders Risk Policy

Do You Have Workers Comp Call Us Today At Toll Free 1 833 682 61 62 And Visit Our Web Beeinsured Co Disability Insurance Business Insurance Compensation

Who Pays For Builder S Risk Insurance Rob Freeman

Builders Risk Insurance Coverage Policies Embroker

Builder S Risk Insurance Course Of Construction Insurance Insureon

Who Pays For Builder S Risk Insurance Rob Freeman

Do You Need Hazard Insurance And Homeowners Insurance Hazard Insurance Homeowners Insurance Homeowner

Builders Risk Insurance The Other Insurance Condition Expert Commentary Irmi Com

Who Pays For A Builders Risk Policy

How Much Does Builders Risk Insurance Cost Commercial Insurance

Builder S Risk Insurance Course Of Construction Insurance Insureon

Top 10 That Affect Home Insurance Rates Home Insurance Homeowners Insurance Insurance

Workers Compensation For Self Employed Contractors The Hartford